We solved the compute constraint. We solved the software constraint. But we overlooked the constraint that matters most: energy. For 15 years, cloud computing won the infrastructure war because it was cheaper than on-premises. That's about to flip - not because cloud got worse, but because energy is becoming finite and expensive. Data centers consume 4-5% of global electricity today. By 2030, that number will be 10-12%, driven almost entirely by AI workloads. Yet energy is the one thing cloud providers can't abstract away - it's physical, local, and finite. Google knows this. So does Amazon. In 2025, they signed the largest long-term renewable energy contracts in history, locking in power supplies for decades. This was not a sustainability move. It was a survival move. Energy is becoming the primary competitive moat in AI infrastructure - and the transition happens fast. By Q2 2026, cloud pricing will spike 25-40% as energy costs surge. On-premises AI infrastructure - dormant for a decade - suddenly becomes competitive again. Companies with locked renewable energy deals (Google, Amazon) will navigate the transition smoothly. Everyone else will face margin collapse. The timing is tight: you have 90 days to lock in multi-year cloud contracts, and 6 months to begin shifting workloads on-premises. This memo explains why energy is the new constraint, who's positioned to win, and what you need to do before Q2 2026.

Executive Summary (The TL;DR)

The hidden crisis: Data centers are locked into 15-21 year renewable energy contracts. Google, Microsoft, and Amazon signed $50B+ in long-term power deals in 2025. This is not temporary - it's a permanent cost basis for the next two decades.

The math: AI power demand grows 50% by 2027, 165% by 2030. Meanwhile, grid capacity upgrades need $720B through 2030 and take 5-10 years to permit and build. Result: structural energy shortage starting Q2 2026.

The consequence: Cloud pricing will spike 15-40% starting Q2 2026 as energy cost increases flow through margins. Companies built on cheap cloud assumptions will face margin collapse. On-prem AI infrastructure becomes competitive again for the first time in 15 years.

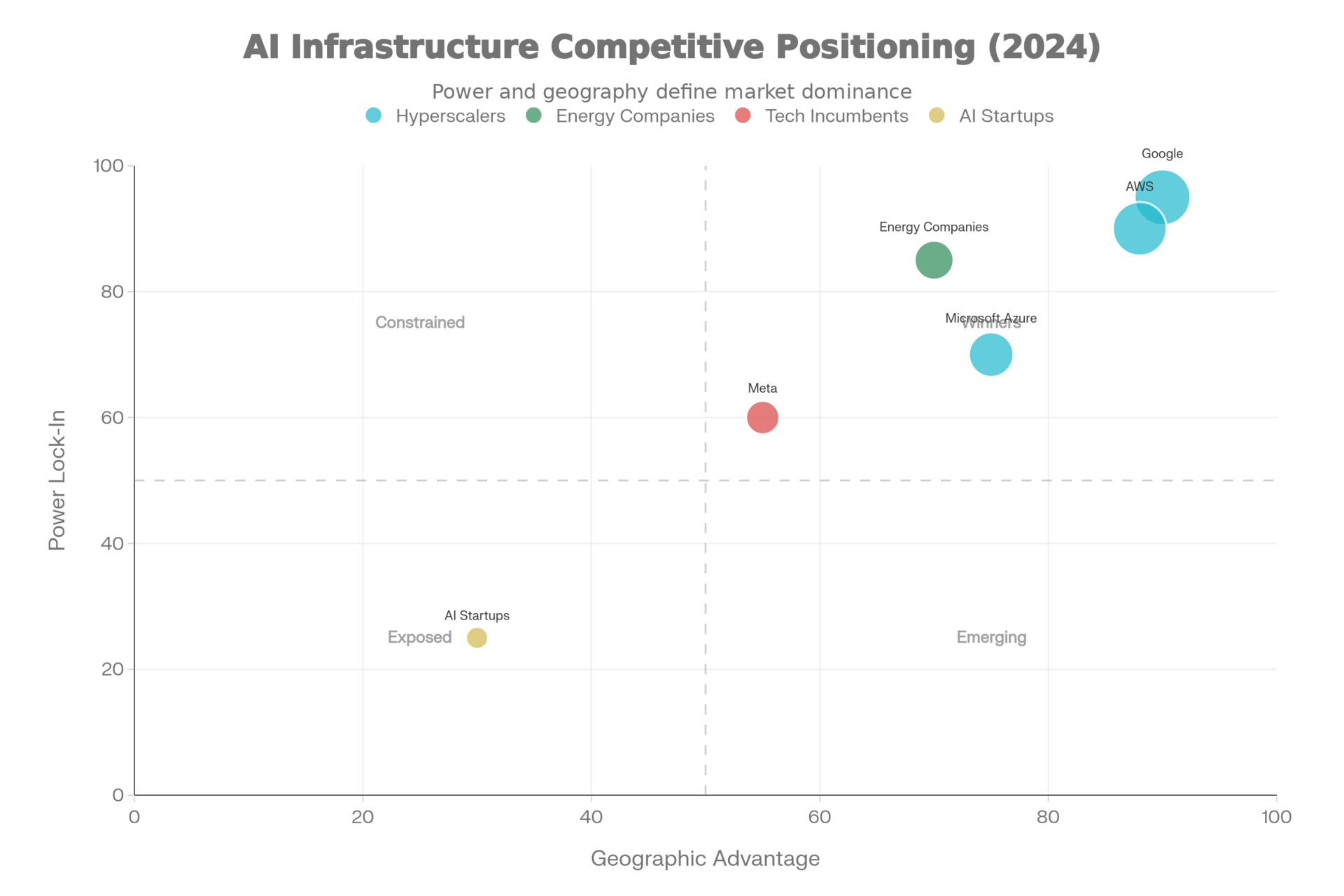

The Market Map & Key Players

Energy scarcity in AI infrastructure creates three distinct competitive positions - winners and losers are already sorting.

Incumbents: Hyperscalers with Locked Power

Google (Alphabet) — Capex $91-93B (2025); locked 2.5 TWh renewable energy in Malaysia + Ohio on 15-21 year PPAs

Incentive: Secure massive power supply before grid capacity runs out; lock in today's renewable rates for 20 years

Position: Strongest—Google Cloud backlog $155B (up 82% YoY). Already monetizing investment at scale

Winning? ✅ YES—Google will absorb price increases into contracts signed now; costs locked for 20 years

Amazon Web Services — Capex $125B (2025), rising "significantly" in 2026; added 3.8 GW power in the past 12 months; $11B St. Louis facility launching

Incentive: AWS backlog $200B+. Every dollar of new capacity is immediately monetized. Power costs are sunk into long-term contracts

Position: Strongest—AWS is the most aggressive power scavenger; will pass through increases to enterprise customers

Winning? ✅ YES—AWS is the most aggressive power scavenger; will pass through increases to enterprise customers

Microsoft Azure — Capex projected $94-140B (2025-2026); Fairwater, Wisconsin 2 GW facility coming 2026; facing capacity shortages through H1 2026

Incentive: Enterprise Azure demand exceeding supply. Must build capacity faster than competitors to capture market share

Position: Constrained but winning—Azure backlog exceeds Google Cloud; margins sustaining despite inflation

Winning? ⚠️ PARTIAL—Microsoft is behind in capacity build, but will win the market share war for 2-3 years. Long-term vulnerable to margin compression unless energy PPAs are excellent

Meta Platforms — Capex ramping; competing for power with hyperscalers

Incentive: Compute-starved for AI training. Must secure power to train competitive models

Position: Mid-tier—not as aggressive as Google/Amazon on energy deals; more vulnerable to grid constraints

Winning? ⚠️ PARTIAL—Meta will face tighter power constraints than hyperscalers; capex will be higher per TFLOP

Disruptors: Energy Companies & Utilities

TotalEnergies, NextEra Energy, utilities (Dominion, We Energies) — Signing multi-decade renewable PPAs with hyperscalers

Incentive: Extract 20-year fixed revenue streams from the AI boom. Lock in customers before supply runs out

Position: Strong—utilities control the bottleneck (power supply)

Winning? ✅ YES—energy companies have structural pricing power. Every AI facility needs power; supply is constrained

Enablers: AI Infrastructure Startups

Lambda Labs, CoreWeave, other colocation/on-prem AI providers — Offering an alternative to cloud for compute-intensive workloads

Incentive: Position on-prem as "cloud-alternative" as cloud pricing spikes

Position: Emerging—not profitable yet, but capturing market share from cloud as margins compress

Winning? ⚠️ PARTIAL—will grow rapidly 2026-2027 as cloud prices spike, but fragmented/niche

Losers: AI Startups Not Backed by Hyperscalers

Startups (Anthropic, xAI, others) relying on cloud compute — Dependent on AWS/Google/Azure pricing

Incentive: Minimize inference costs to stay competitive

Position: Weak—will face cascading cost increases and margin compression if dependent on the cloud

Winning? ❌ NO—unless backed by hyperscaler infrastructure, face existential cost pressures 2026-2027

Data Analysis & Benchmarks

The numbers make the energy constraint impossible to ignore.

Power Demand Explosion

Metric | 2023 | 2025 | 2027 | 2030 | Source |

|---|---|---|---|---|---|

Global DC power demand | Baseline | +22% | +50% | +165% | S&P Global, Goldman Sachs, IEA |

US data center electricity % | 4.4% | 5.2% | 6.7-7% | 6.7-12% | US Dept. of Energy |

AI servers alone | 53-76 TWh | ~90 TWh | ~150 TWh | 165-326 TWh | MIT analysis |

Equivalent to: | Thailand's annual use | Germany + Austria | 22% US homes | Japan's total demand | IEA |

Translation: By 2028, AI servers alone will consume more electricity than all US data centers consumed in 2023. This is exponential, not linear.

Cost Impact in Real Markets

Wholesale electricity prices in data center regions (5-year change):

Northern Virginia (Data Center Alley): +267% (Sep 2025 vs. Sep 2020)

Texas (major DC region): +180-220% (dominant new power consumer by far)

Wisconsin (Microsoft Fairwater): Dominion requesting +20% capacity build; residential rates up $20/month

This is NOT speculative. These are actual prices in markets with heavy data center concentration.

Capex Intensity Shows the Squeeze

Big Tech aggregate capex spending:

2023: ~$130B total

2024: ~$230B total

2025: ~$380B total (45% increase YoY)

2026: Projected $500B+ (another 30% increase)

Key constraint: CFOs are saying capex is "accelerating" not slowing. Amy Hood (Microsoft CFO): "We've been short now for many quarters. Demand is increasing."

Goldman Sachs estimate: AI capex will consume 94% of Big Tech operating cash flows in 2025-2026 (up from 76% in 2024). "It's getting close to 100%"—meaning they'll have to borrow or cut dividends.

Energy Costs Are Now the Margin Driver

Google Cloud margin pressure emerging:

Anat Ashkenazi (Google CFO, Q3 2025): "Higher technical infrastructure usage costs, including depreciation and energy expenses," cited as margin pressure

This is the first public signal that energy costs are hitting operating margins

Microsoft is facing a depreciation spiral:

Satya Nadella: "Continuous cycle of modernizing and depreciating hardware fleet."

Each refresh increases energy costs (denser, more power-hungry hardware)

Depreciation accelerates as hardware cycles compress

Timeline: When the Squeeze Hits

Quarter | Event | Impact |

|---|---|---|

Q4 2025 | TotalEnergies/Google Malaysia deal closes; $11B Amazon St. Louis online | Energy costs lock in for 20 years |

Q1 2026 | Fairwater Wisconsin 2 GW facility comes online; existing PPAs start depreciating | First margin pressure visible in earnings |

Q2 2026 | Grid constraints tighten as capacity utilization hits 85%+ | Cloud pricing increases announced |

Q3-Q4 2026 | Second wave of energy deals close; prices locked for 2027 | Cloud price increases take effect |

2027 | On-prem AI infrastructure becomes economically viable for enterprises | Enterprise workload shift begins |

The Decision Checklist & Strategic Scenarios

An optimistic but cautious leader does not try to predict exactly which chip or quantum architecture will win; instead, they design a portfolio and process that can adapt as evidence arrives.

Decision Checklist: Energy Strategy for Your Organization

Is your AI workload energy-intensive enough to negotiate direct power PPAs?

If >10 MW continuous load, YES. Work with your cloud provider or negotiate colocation directly.

If <10 MW, stay on cloud but lock in multi-year pricing contracts NOW before increases are announced.

Which geographies have accessible renewable power with favorable PPAs for 2026-2032?

Ohio, Texas, Malaysia, Scandinavia: YES (hyperscalers are locking these up; secondary access still available)

California, New York, Virginia: NO (constrained grid, premium pricing)

Europe: Complex (regulatory barriers, but good renewable access)

Does your cloud vendor have locked-in renewable PPAs, or are you exposed to dynamic pricing?

Google/Amazon: ✅ Most secured (15+ TWh locked through 2040+)

Microsoft: ⚠️ Partial (catching up but behind)

Smaller cloud providers: ❌ Exposed to grid constraints and price volatility

Should you move inference on-prem given the coming cloud price spikes?

If inference >60% of workload: YES, model economics now favor on-prem (2-3 year payback)

If inference <30%: Stay cloud (faster iteration, less capex risk)

If mixed: Hybrid (cloud for training, on-prem for inference by 2027)

How much of your AI capex should shift from cloud consumption to on-prem hardware by 2026?

Recommend: 30-40% on-prem by the end of 2026; 50-60% by 2027

Monitor: Cloud pricing announcements (will come Q2 2026); lock in multi-year contracts before increases

Are you pricing AI features with cloud cost assumptions from 2024?

If YES: Your margin model breaks Q2 2026. Rebuild now with 25-35% cloud cost increase assumption.

If NO: You're ahead; model for a 40% increase buffer to be safe.

Should you consolidate on one cloud provider or support multi-cloud for portability?

Consolidate on the provider with the best energy PPAs (Google > Amazon > Microsoft)

Multi-cloud is a luxury for 2027+; in 2026, you want predictable energy costs, not complexity

Strategic Scenarios

Scenario 1: "The Orderly Transition" (Probability: 30%)

Premise: Hyperscalers successfully lock in enough renewable power through 2026. Grid upgrades accelerate. Energy costs rise 15-20%, not 40%+.

What happens:

Cloud pricing rises 15-20% in 2026-2027 (recoverable through efficiency)

On-prem AI adoption accelerates but doesn't go mainstream

Startups depending on cloud survive with margin compression

Winners: Established cloud vendors; losers: highest-cost startups

Your move:

Multi-year cloud contract NOW (lock current pricing)

Gradual on-prem shift (pilot inference on-prem by Q4 2026)

Prepare to absorb 15-20% cloud cost increase in product pricing

Scenario 2: "The Constrained Reality" (Probability: 55%) ← MOST LIKELY

Premise: Energy supply can't keep up with demand growth. Grid permitting delays cascade. Energy costs spike 35-50% by 2027. Hyperscalers ration capacity.

What happens:

Cloud pricing increases 30-40% Q2 2026

Hyperscalers implement "priority customer" tiers (Tier 1: existing enterprise, get new capacity; Tier 2: startups, waitlisted)

AWS/Google backlogs shrink as pricing kills marginal demand

On-prem infrastructure becomes mainstream; Lambda, CoreWeave, others scale rapidly

Enterprise customers shift inference on-prem; keep training on cloud

Startups without hyperscaler backing face existential margin pressure

Your move:

Lock in multi-year cloud contracts ASAP (before Q2 2026 announcement)

Pilot on-prem inference now (6-month lead time to deployment)

Plan 50% on-prem capex shift by Q4 2026

Negotiate energy PPAs if >10 MW load; if <10 MW, explore colocation

Scenario 3: "The Supply Shock" (Probability: 15%)

Premise: Major blackout or grid failure. Regulatory crackdown on data center expansion. Energy prices spike 80%+ by 2027.

What happens:

Cloud vendors ration capacity aggressively

Startups without an on-prem fallback lose customers to competitors

Enterprise shift to on-prem accelerates dramatically

Second-tier cloud providers (Azure, Oracle) gain share from AWS/Google as demand exceeds supply

Energy companies become the most powerful players in AI infrastructure

Your move:

Don't wait—move 60% workload on-prem by Q3 2026

Diversify cloud vendors (don't be AWS-dependent)

Negotiate energy PPAs immediately

Have backup colocation arrangements locked in

Our Core Thesis

The energy constraint is structural and permanent. Cloud pricing will spike 25-40% starting Q2 2026. Organizations that lock in multi-year cloud contracts NOW and begin shifting inference workloads on-prem by Q3 2026 will maintain margin stability. Those who wait for pricing announcements will face existential margin pressure in 2027.

Energy arbitrage—who controls power, at what cost, for how long—will be the primary competitive moat in AI infrastructure for the next 5 years, not chip speed or model capability.

Recommended stance: Scenario 2 (Most Likely). Lock in cloud pricing now. Pilot on-prem by Q3 2026. Be prepared to shift 50% of inference workload on-prem by the end of 2026. This hedges against both orderly transition and constrained reality.

Strategic Resources

These frameworks, benchmarks, and analysis tools will help translate the insights from this memo into an organizational strategy.

Energy Economics & PPA Strategy

Understanding Power Purchase Agreements (PPAs) for Data Centers — Essential primer on negotiating long-term renewable energy contracts. Covers PPA structure, risk allocation, financial modeling, and typical 15-25 year contract terms used by hyperscalers.

McKinsey: 24/7 Clean Power Purchase Agreements — Strategic framework explaining how hyperscalers are winning the renewable energy race. Includes decision matrix for evaluating PPA economics and geographic arbitrage opportunities.

Cloud vs. On-Prem Economics

Deloitte: AI Infrastructure Compute Strategy for Enterprises — Executive decision framework for on-prem vs. cloud economics. Updated Dec 2025 with scenario modeling and 2026 pricing projections for infrastructure leaders.

ABI Research: AI Infrastructure Investment & ROI Analysis — Quantitative ROI modeling for on-prem GPU/TPU deployments. Includes total-cost-of-ownership calculators and comparison benchmarks with cloud alternatives across workload types.

Brightlio Colocation Pricing & Economics Guide — Updated pricing benchmarks for colocation facilities vs. cloud consumption models. Useful for modeling hybrid infrastructure scenarios and infrastructure capex ROI.

Energy Market Analysis & Geographic Intelligence

Bloomberg: AI Data Centers Are Sending Power Bills Soaring — Real-time electricity price tracking by geography and market segment. Interactive map showing 267% price increases in data center regions over 5 years and forward pricing curves.

MIT Technology Review: AI Energy Usage & Climate Footprint — Authoritative analysis of AI power consumption at scale. Includes quantified estimates of power draw by model type and workload, projections through 2030, and regional grid constraints.

Grid Operator & Capacity Monitoring — Official grid operations and capacity data from regional transmission organizations (RTOs). Use to identify regions of peak constraint, permitting delays, and emerging bottlenecks.

Hyperscaler Strategy & Competitive Intelligence

Bloomberg: AI Infrastructure Capex Tracking — Real-time tracker of Google, Microsoft, Amazon capex spending, facility announcements, and energy deal news. Updated quarterly with earnings disclosures and infrastructure timelines.

S&P Global: Data Center Market Intelligence — Competitive analysis of hyperscaler infrastructure strategies, capex allocations, regional deployment patterns, and power security positioning.

Credible Sources & References

All claims in this memo are sourced from official company earnings disclosures, government reports, and peer-reviewed research published in 2024-2025:

Big Tech AI Investment Capex Q3 2025 Earnings — Official Earnings Disclosures & Analysis | Oct 31, 2025

Alphabet (Google) Capex $91-93B Forecast — S&P Global Q3 2025 Earnings Analysis | Dec 1, 2025

Microsoft Capex $94-140B Forecast — CNBC Q3 2025 Earnings Summary | Oct 31, 2025

Amazon AWS Capex $125B+ Plan — S&P Global Q3 2025 Earnings Analysis | Dec 1, 2025

TotalEnergies 21-Year Malaysia PPA Deal — Official Press Release | Dec 18, 2025

Google Cloud Backlog $155B (Up 82% YoY) — S&P Global Q3 2025 Analysis | Dec 1, 2025

AWS Backlog $200B, Added 3.8 GW Power — S&P Global Q3 2025 Analysis | Dec 1, 2025

Goldman Sachs: Data Center Power Demand +165% by 2030 — Goldman Sachs Research | May 2024; Reaffirmed 2025

IEA: Data Center Electricity to 945 TWh by 2030 (Japan equivalent) — IEA Report | 2025 Projections

US Dept. of Energy: Data Centers 6.7-12% US Electricity by 2028 — DOE December 2024 Forecast; Cited Nov 2025

Bloomberg: Wholesale Electricity +267% in Data Center Regions — Bloomberg Data Analysis | Sep 29, 2025

MIT: AI Power Consumption 53-76 TWh (2024), 165-326 TWh (2028) — MIT Analysis | May 20, 2025

S&P Global: Data Center Power Demand +22% in 2025, Nearly Doubling by 2027 — S&P Global Market Intelligence | Oct 13, 2025

AI Data Centers: Power Consumption Up to 100 kW per Rack — BlackRidge Research | Jun 23, 2025

CNN: Data Centers Projected 6.7-12% US Electricity by 2028 — CNN Analysis | Oct 17, 2025